"The first time through SGDS1, I thought it was the best CE I have had in my career. The second time through was, in many ways, even better."

Chris G. from Cornelius, NC

Certified General Appraiser

George Dell in Bloomington, MN

September 25 & 26, 2025 for Stats, Graphs, and Data Science 1. Join George with members of the Community of Asset Analysts (CAA) as they teach Evidence Based Valuation(c)

Stats, Graphs, and Data Science1

This is a 14-hr CE workshop applying modern data science methods, predictive analysis, and evidence-based© valuation. It emphasizes hands-on activity-based learning using real data. A laptop is required for this course. No iPads or Android tablets. Avoid newer Surface laptops with the Snapdragon CPU.

Students leave with two immediately useful and fast analytical modeling tools: adjustments using contrasting, and simple regression using RStudio, Quarto, and Excel.

Class is activity-based: we request (not required) that you download a small (10 – 40 listings) from your own MLS in .CSV format. (Data sets are provided for those who are unable to download a data set.) We will clean it, visualize it, then model it in R. (Excel or other open-source spreadsheet software can be used but primarily it is used only as a scratch pad.)

George Dell teaches that appraisers need to use complete market data sets (“competitive market segment”) rather than hand-picked comps, and let “the data speak for itself”.

Every step is documented so results are auditable and reproducible—key pillars of his Evidence-Based Valuation paradigm and the new guidelines in the UAR 3.0

The importance of Objective data selection is presented by the use of visual plots. Summary statistics in market selection and for comparison support is also emphasized.

These tools are particularly useful for sparse-data appraisal problems through support of location adjustments and price indexing of older data.

R, (with RStudio), one of the most widely used data analysis software programs is introduced and compared to traditional accounting spreadsheet add-ons. These open-source software packages are provided at no charge. Assistance with download and installation are provided after registration if you need it. Excel application is also shown. Laptop required for this hands-on course! No iPads or Android tablets. Avoid newer Surface laptops with the Snapdragon CPU. Microsoft Surface Tablets are usually okay. Check with Valuemetrics support.

Included with this class:

- Hands-on Instruction and class exercises

- Open-source graphics, data analysis, and reporting software

- State CE Certification for Minnesota and other states: WI, OH, IL, MI, IN, VT, DE, MO, CA, NC, SC, TN, CA, OR, UT, PA, MA, CO, TX, OK

- Approved by the Appraisal Institute Canada

- Student attendance certificate provided at the end of class

Bonuses:

Reference Book, Handouts, and Practice Data Sets also provided.

Half-Price Tuition for Returning Students (conditions apply).

75% off for current paid subscribers of The Asset Analyst Report

Contact Support at Valuemetrics.Info if you have questions about possible discounted pricing.

Meet George Dell, SRA, MAI, ASA, CRE

George Dell is the creator and developer of Evidence-Based Valuation©. This New Valuation Modeling Paradigm© emphasizes modern open-source analytics software. The introductory course, Stats, Graphs and Data Science1 initiates new appraiser products and services, combining appraiser expertise with data science tools.

Mr. Dell has been published multiple times in The Appraisal Journal including, “Regression, Critical Thinking, and the Valuation Problem Today” in the 2017 Summer Edition.

His extensive graduate education led him to reexamine traditional statistics and “three-comp thinking.” The resulting curriculum brings technology-empowered valuation methods to appraisers. The practice begins with evidence-based data selection, replacing the "experience-based" method. It ends with a reproduceable report, scored for reliability and forecasting. This eliminates the need for subjective “appraisal review.”

GeorgeDell.com’s free weekly blog raises forward looking issues. He is the founder of the Community of Asset Analysts, a private, no-cost, forum for the sharing of analytical packages and data science applications for graduates of Stats, Graphs, and Data Science 1. He is the editor of The Asset Analyst Report (TAAR)©.

Meet John Fariss, MNAA, CAA

John Fariss began appraising in 2002. In 2004, he moved to Bakersfield, CA. Since then, he has appraised residential properties across one of the largest counties in the USA.

After taking George Dell's "R for Appraisers" course in 2019, he began volunteering to assist with Stats, Graphs, and Data Science classes with the Valuemetrics program.

John regularly teaches other appraisers how to use RStudio and Quarto for data analysis, modeling, and report automation—through live classes with George Dell, his own educational videos, and one-on-one consulting where he helps appraisers to adopt transparent, replicable, and data-driven valuation methods. John is a leading member of the Community of Asset Analysts (CAA) where graduates of George Dell's classes support one another in building a practice focused on Evidence Based Valuation (EBV).

Specialties: Manufactured homes, 2–4 unit residential income properties, new construction, spec home appraisals, retrospective valuation, and litigation support.

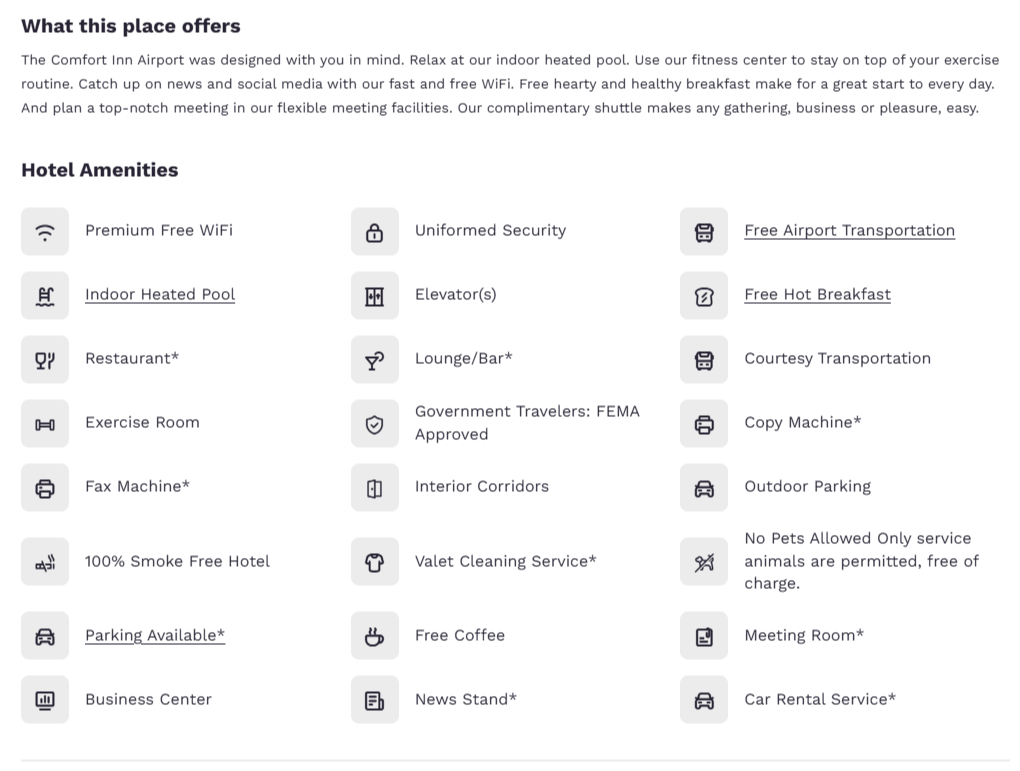

Hotel Info

Comfort Inn MSP Airport - Mall of America 1321 78th St. Building A Bloomington, MN 55425

We are not able to offer a discount package for our out-of-town students.

Check with your favorite discount hotel app, such as Kayak.com, Hotels.com, PriceLine.com or the parent company of Comfort Inns, ChoiceHotels.com.

If you are coming from out of town:

The hotel offers a complimentary shuttle to take care of the fifteen-minute drive to the airport. The closest major airport is Minneapolis/St. Paul International Airport.

Dining Options:

When it’s time for dinner, check out the world-class options in downtown Minneapolis, just twenty minutes from our hotel. Or take the five-minute drive to Mall of America, where you can find a variety of restaurants to suit any taste.